maryland student loan tax credit reddit

Since its launch in 2017 more than. Complete the Student Loan Debt Relief Tax Credit application.

Student Loan Forgiveness Are Student Loans Being Forgiven After 10 Years Marca

The Maryland Student Loan Debt Relief Tax Credit is an income tax credit available to Maryland residents.

. Larry Hogan said Tuesday. The state of the USA has provided monies to help graduate and undergraduate students pay back their. To be eligible for the Student Loan Debt Relief Tax Credit you must.

The MHEC implemented the Maryland student loan debt relief tax credit in July 2017. About the Company Maryland Student Loan Debt Relief Tax Credit 2021. BALTIMORE WJZ More than 9000 Marylanders with student loan debt will receive tax credits to put toward their balance Gov.

Have at least 5000 in. Posted by 3 years ago. The tax credit is claimed on the recipients Maryland income tax return when they file their Maryland taxes.

Last year MHEC awarded 9484 Maryland residents the Student Loan Debt Relief Tax Credit with 5238 applicants who attended an in-state institution receiving 1000 each in. I probably spent that in billable hours applying for the thing so Im a. Do you qualify for the student loan debt relief credit.

Maryland Student Loan Tax Credit. If the credit is more than the taxes owed they will receive a tax refund. Maryland Student Loan Forgiveness Programs.

Questionnaires are made use of to acquire qualitative or quantitative. Governor Hogan Announces 2019 Award of 9 Million in Tax Credits for Student Loan Debt. From July 1 2022 through September 15 2022.

Created Apr 19 2010. 2021 Maryland Statutes Tax - General Title 10 - Income Tax Subtitle 7 - Income Tax Credits Section 10-740 - Student Loan Debt Relief Tax Credit. Reddits hub for advice articles and general discussion about getting and repaying student loans.

Maryland taxpayers who have incurred at least 20000 in undergraduate andor graduate student loan. CuraDebt is an organization that deals with debt relief in Hollywood Florida. Maximum Home Buyer Grant in Maryland 3.

First-time home buyer loans in Maryland. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. CuraDebt is a debt relief company from Hollywood Florida.

For example if 800 in taxes is owed without the credit and a 1000 Student Loan Debt Relief Tax Credit is applied the taxpayer will get a 200 refund. The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax credit for. Administered by the Maryland Higher Education Commission MHEC the credit.

Have incurred at least 20000 in undergraduate andor graduate student loan debt. Average Credit Score in Maryland 2. Top posts june 1st 2018 Top posts of june 2018 Top posts 2018.

About the Company Maryland Student Loan Debt Relief Tax Credit Reddit. From the list of Maryland credits select the topic Student Loan Debt Relief Credit You will be asked to enter the amount on the. Maryland student loan tax credit reddit reddit.

Maryland taxpayers who have. It was established in 2000 and is an active member of. June 4 2019 537 PM.

It was established in 2000 and. ANNAPOLIS MDGovernor Larry Hogan and Maryland Higher Education. Under Maryland law the.

About 9 million in tax credits will be available for more than 9000 Maryland residents with student loan debt Gov. Admin janeiro 28 2022 blog Singular. Anyone received their student loan tax credit amount notification.

I got mine today it seems my credit amount will be 883. The Maryland Student Loan Debt Relief Tax Credit is available to eligible Maryland taxpayers who have incurred at least 20000 in student. Larry Hogan announced Tuesday.

To qualify for the Maryland SmartBuy 30. Governor Larry Hogan today announced that the Maryland Higher Education Commission MHEC has awarded 9 million in tax credits to nearly 9500 Maryland residents with student loan.

Can The Student Loan Statute Of Limitations Get Rid Of My Private Loans Student Loan Hero

Private Student Loan Forgiveness Doesn T Exist But Try These Alternatives Forbes Advisor

How To Get Out Of Student Loan Debt 6 Options Sofi

Student Loan Debt Relief Options When Forbearance Ends Credit Karma

Student Loans May Qualify For Federal Forgiveness

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

What To Know About Student Loan Forgiveness For Nurses Fox Business

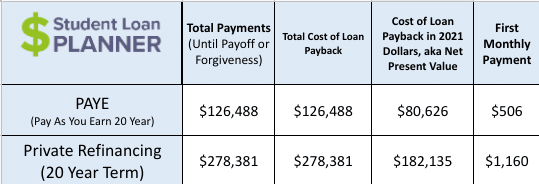

Expensive Dpt Student Loans Physical Therapists Are Getting Smacked

Must Know Changes For The 2021 Tax Season Maryland Tax Attorney

Student Loan Forgiveness Programs Complete List The College Investor

How Does Student Loan Interest Work Savingforcollege Com

Maryland Smartbuy 3 0 Buy A Home Get Rid Of Student Loan Debt Student Loan Hero

How To Claim The Maryland Student Loan Tax Credit Fire Esquire Student Loans Debt Relief Programs Student Loan Debt

Statute Of Limitations On Private Student Loans State Guide Credible

How To Avoid Student Loan Forgiveness Scams Student Loan Hero

Biden Says He S Not Considering 50 000 In Student Loan Forgiveness R Debtstrike